The Relevance of Accounting Information

The finance theory predicts that accounting information is fully incorporated into market prices or securities and, therefore, irrelevant for explaining changes in financial variables. Contrary to this prediction, studies show that accounting information are incrementally informative in explaining firms’ credit ratings as well as a market-based measure of credit risk, i.e. the credit spread of corporate bonds.

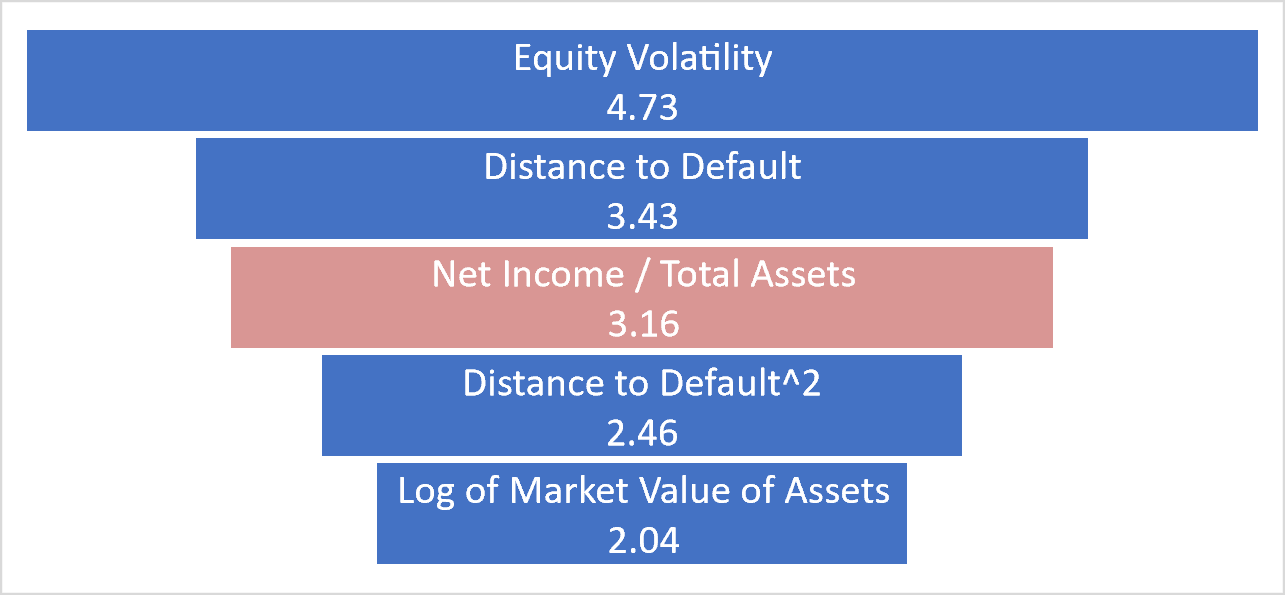

Figure. The absolute values of t-statistics of significant variables in explaining changes in the credit spread on corporate bonds (the accounting-based measure is in red)

Related articles:

Demirovic, A., Tucker, J., Guermat, C. (2017) The Relationship between Equity and Bond Returns: An Empirical Investigation, Journal of Financial Markets, Vol. 35-C, pp. 47-64. https://doi.org/10.1016/j.finmar.2017.08.001.

Demirovic A., Thomas, D.C. (2007) The Relevance of Accounting Data in the Measurement of Credit Risk. The European Journal of Finance, Vol. 13-3, pp. 253-268. https://doi.org/10.1080/13518470601025177.